TO BE NOTED: From Morgan Stanley via Zero Hedge:

Review and Preview

March 31, 2009

By

Ted Wieseman |

New York With all the big announcements about the Treasury’s legacy asset and loan purchase plans and strong rallies seen in most risk markets in response, as well as some better-than-expected economic data, Treasury and other interest rate markets had a surprisingly quiet week that was mostly focused on supply and left Treasury yields mixed. In addition to largely ignoring the surge in stocks and rallies to varying extents in other key markets in response to the Treasury plan – with a very strong rally by the commercial mortgage CMBX market versus a comparatively soft response by the subprime ABX market particularly interesting – Treasuries also paid almost no attention to a round of overall better-than-expected data, probably partly because investors were looking ahead to what’s expected to be a rough run of more important early figures for March in the coming week’s employment, ISM and motor vehicle sales results. The data were also a good bit better on a headline basis in a number of cases than in some of the important underlying details. New and existing home sales both posted rebounds off their lows in February but showed little progress in working down the severely bloated inventory situation heading into the key spring selling season. Both overall and core durable goods orders posted good gains in February but only after extremely large downwardly revised declines in January. Even with a slight recovery in February, capital goods shipments were so weak in the revised January numbers that the outlook for 1Q investment continued to worsen. Fourth quarter GDP growth was revised down less than expected to -6.3% from -6.2% but partly because of a smaller downward adjustment to inventories that pointed to a partly offsetting larger inventory drag in 1Q. Even with a stronger path for 1Q consumption implied by the personal income report, we cut our 1Q GDP estimate to -5.1% from -4.9%. Instead of trading on the Treasury plans, other markets’ reactions to the plans or the economic news, supply was the overriding market focus in what activity there was during the week’s sluggish trading, and this cuts two ways. The Fed’s surprise announcement that it would be including long bonds in its initial round of Treasury purchases after previously saying buying would be focused in the 2-year to 10-year range helped the long end outperform on the week. And the very rapid start to the buying program provided additional support. As heavy as the Fed’s US$15 billion in purchases was, it was only a fraction of the record US$98 billion of new coupon supply in 2s, 5s and 7s during the week. After a solid start to the three auctions with Tuesday’s 2-year, the week’s Treasury market lows were hit after a poor 5-year sale Wednesday that added to supply jitters from the failed UK gilt auction. Once the much better 7-year auction wrapped up the supply on Thursday, however, and the market was able to look ahead to a busy schedule of Fed buying combined with a week-and-a-half break in new issuance, the market was able to rebound to close the week Thursday and Friday.

For the week, benchmark Treasury yield moves ranged from modest gains driven by the Fed’s surprise announcement to decent losses in the intermediate part of the curve led by the 7-year, which reversed much of its strong outperformance in initial response to the FOMC’s Treasury buying announcement. The old 2-year yield was flat at 0.86%, 3-year up 4bp to 1.26%, old 5-year up 12bp to 1.76%, old 7-year up 15bp to 2.31%, 10-year up 13bp to 2.76% and 30-year down 6bp to 3.62% (for the new issues, there was about a 4bp yield pick-up for the 2-year and 5-year and 6bp for the 7-year). Even with risk markets surging, demand for cash reached new extremes, though this may have mostly just reflected quarter-end book-squaring. Very short-dated bills closed negative Thursday before reversing course slightly on Friday to leave the 4-week bill’s yield down 7bp to 0.01%. For the week, commodity prices weren’t much changed, with only small further upside in oil prices in particular, but TIPS performed extremely well even after a partial pullback to extend what’s now been a three-week run of major outperformance. The 5-year TIPS yield fell 13bp to 0.82%, 10-year 4bp to 1.34% and 20-year 14bp to 1.92%. Current coupon 4% mortgages ended the week about unchanged (and with little day-to-day volatility) to outperform the sell-off in the intermediate part of the Treasury curve (though performance was notably worse on an option-adjusted spread basis as interest rate volatility declined). This left yields on 4% MBS a bit above 3.9%, down from near 4.15% two weeks ago and the year’s highs above 4.3% at the end of February. Mortgage rates being offered to consumers have tracked the rally in the MBS market, falling to record lows in the latest week.

Fed Treasury buying got off to a fast start, with two US$7.5 billion purchases, the first in the 7-year to 10-year range and the second 2-year to 3-year. Interestingly, by far the biggest purchase in the former was of the on-the-run 7-year issue and almost all of the buying in the latter was in the current 3-year. The Fed always stayed away from buying benchmark issues in the past as it expanded its Treasury portfolio gradually over the years (until reversing course after mid-2007 when it began selling down a large portion of its Treasury holdings as it was initially sterilizing its other liquidity facilities). But the goal now is clearly to lower broader borrowing costs as effectively as possible, not to gradually expand the Fed’s balance sheet in a non-market disruptive way in the manner of previous historical coupon passes, and these first two operations certainly suggest that the Fed quite reasonably thinks that largely focusing on supporting yields on the benchmark issues is the best way to do this. There will be three more rounds of Fed buying in the coming week – August 2026 to February 2039 maturities Monday; May 2012 to August 2013 Wednesday; and September 2013 to February 2016 Thursday. This additional buying will come during an off week for new Treasury coupon supply before 10-year TIPS, 3-year and 10-year auctions the week of April 6. On top of the fast start to the Treasury buying, the Fed’s net purchases of MBS of US$33 billion in the most recent week were also a new high, though the past week’s agency purchase (agency purchases are expected to take place generally once a week going forward under updated guidelines released by the New York Fed) of US$2.7 billion was around the average size seen up to this point. A continued pick-up in the pace of mortgage purchases may be needed in the weeks ahead as refinancings are likely to ramp up very sharply and put substantial supply pressures on the mortgage market.

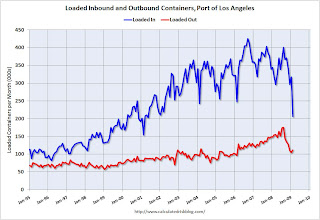

The announcement of the Treasury’s legacy asset and loan purchase plans helped risk markets generally extend or resume significant rebounds that in most cases started off lows hit March 9. The S&P 500 gained another 6% on the week for a 21% rebound from the March 9 low. Financials continued to lead the bounce, with the BKX banks stock index up 12% on the week, but their leadership position faded late in the week after a stronger initial outperformance in response to the Treasury’s announcement. In corporate credit, the new series 12 investment grade CDX index tightened 15bp to 184bp in its first full week of trading, while the prior series 11 closed the week near 225bp after hitting a recent wide of 262bp on March 9. The high yield index was 132bp tighter on the week at 1,619bp through Thursday, down from 1,894bp on March 9, but the index was trading off about 3/4 of a point Friday. The leveraged loan LCDX index, which could benefit from the legacy loan portion of the bad bank plan, had a very good week but remained pretty far in the red for the year. Through midday Friday, the index was 379bp tighter on the week at 1,893bp, near its best level since the first half of February but still quite a bit wider than the 1,303bp close at the end of 4Q. The relatively strongest response to the Treasury plan was in the highest-rated parts of the commercial real estate market. The AAA CMBX index tightened nearly 200bp on the week to 559bp, wiping out almost all of the prior year-to-date losses. While the Treasury’s plan was clearly taken as good news for owners of high-quality commercial mortgage-backed securities (though AAA cash CMBS still trades quite a bit wider than the AAA CMBX index at this point, and lower-rated CMBX indices did not perform nearly as well), our desk notes that current spreads are still astronomically higher than where they traded a couple years ago before the financial crisis began – currently about 900bp for AAA CMBS versus only about 25bp pre-crisis. As a result, commercial real estate funding is punishingly expensive even after the recent market rebound, continuing to put intense pressure on commercial property valuations. Meanwhile, a comparatively much weaker performance by the subprime ABX market sharply contrasted with the CMBX strength. The AAA ABX index only gained 2 points from the record lows hit last week and at 26.17 is still down 33% so far this year. Lower-rated ABX indices saw almost no upside from recent record lows, with the AA index only up 0.02 point to 4.04 (incredibly, this index once traded as high as 97.00). Although the muted performance of the subprime market to some extent probably reflected uncertainties about how effective the Treasury’s plan would be, there appeared to be at base a simpler explanation. In contrast to the apparent assumption of the Treasury and many investors, our desk does not believe that current levels in the ABX market, even as far as they have crashed, have been trading at substantially depressed fire-sale prices relative to horrendous underlying fundamentals, so bids well above current market prices for these assets by the PPIFs or through the TALF seem unlikely. ( NB DON )

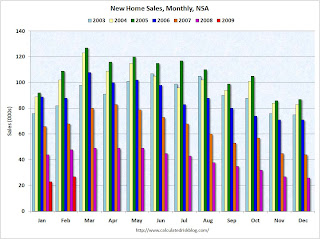

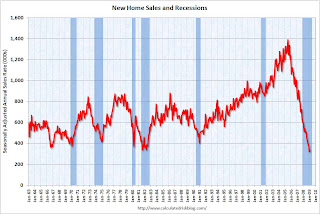

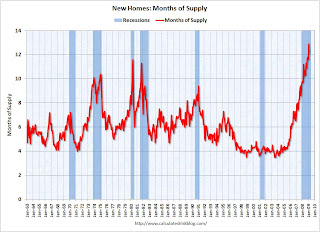

The past week saw a somewhat more positive tone to the economic data after what’s been mostly a steady run of gloomy results for some time, though underlying details of the figures in many cases weren’t as good as the headline results. For example, home sales rebounded, but there was little improvement in the horrendous inventory situation as we move into the key spring selling season. New home sales rose 4.7% in February to a 337,000 unit annual rate, rebounding from the all-time low hit in January to the second worst reading ever. Even with the number of homes available for sale down for a 22nd consecutive month to a seven-year low, the months’ supply of unsold new homes only moderated to 12.2 months from the record high 12.9 months hit in January. Around 5-6 months of supply would be consistent with a balanced market, so inventories are still completely out of hand heading into the crucial spring selling season. Meanwhile, existing home sales gained 5.1% in February to 4.72 million after hitting a 12-year low, but inventories were unchanged, remaining badly elevated at 9.7 months. Similarly, durable goods orders at first glance looked much better than expected, but underlying details, in particular the extent of the revisions to prior months, ended up being much more negative. Overall durable goods orders jumped 3.4% in February, but this followed a downwardly revised 7.3% plunge in January and still left orders down at a near record 35% annual rate over the past six months. Non-defense capital goods ex-aircraft bookings, the key core gauge, jumped 6.6% in January, but this similarly followed a downwardly revised 11.3% collapse in January, a record decline, and left the recent trend extraordinarily weak. Non-defense capital goods shipments ticked up 0.6% in February but only after a record downwardly revised 8.9% drop in January, pointing to severe weakness in business investment in the first quarter. We cut our forecast for 1Q equipment and software investment to -29% from -24.5% and overall investment to -27% from -24%. A 27% drop in current quarter investment following the 22% fall in 4Q would mark the worst six-month decline since the Great Depression. The inventory drag in 1Q also appears likely to be worse, as durable goods inventories fell a larger-than-expected 0.9% in February on top of a downwardly revised 1.1% drop in January. Note that the drop in sales has been so severe, however, that even with this sharp recent pullback, the I/S ratio in this sector remains very close to a 17-year high. On top of the weakness in durable goods inventories early in 2009, the smaller-than-expected downward revision to 4Q growth to -6.3% from -6.2% (and the way too high -3.8% advance estimate) was partly a result of a smaller-than-expected downward revision to inventories, pointing to a likely greater drag from inventories in 1Q. We now see inventory destocking knocking 2.1pp off 1Q growth instead of 1.5pp.

Against the expected bigger negatives from investment and inventories, the consumption picture at least looks a bit better. Real consumer spending fell 0.2% in February, as expected, but January was revised up to +0.7% from +0.4%. As a result, we now see 1Q consumption rising 1.3% instead of +0.9%. While the swing into positive territory would be a positive development, the upside we’re forecasting would mark a meager rebound after a near-record 4.1% annualized collapse in 2H08. Combining the expected downside in investment and inventories against the upside in consumption and also incorporating our February trade forecast and other underlying details of the 4Q GDP revision, we marginally reduced our 1Q GDP forecast to -5.1% from -4.9%. With 4Q GDP only being revised down to -6.3% instead of the -6.8% we were expecting, the net decline in the economy over the 4Q/1Q period still looks to be extremely severe, but slightly less so than we were forecasting coming into the week.

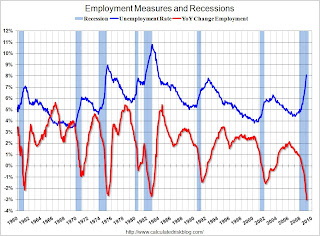

After some recently rare improvement in some of the economic data seen over the past week, we expect the key early round of March data to have a much more negative tone. We look for the worst employment report yet in this downturn, some renewed weakness in the ISM (though less so than we anticipated coming into the week after better results from the second round of regional reports), and another disastrous month for motor vehicle sales. Key data releases due out in the coming week include consumer confidence Tuesday, ISM, construction spending and motor vehicle sales Wednesday, factory orders Thursday, and employment Friday:

* We look for the Conference Board’s consumer confidence index to rise to 26.0 in March. Both the Michigan and ABC gauges suggest that sentiment was little changed during early March, so we look for the Conference Board measure to hold near the record low of 25.0 posted in February.

* We expect the ISM to decline a point to 35.0 in March. The regional surveys released to this point have been mixed. On an ISM-weighted basis, Empire and Philly posted declines, while Richmond and KC registered gains. So, we look for another relatively steady result on the ISM. The key orders gauge is expected to show an uptick, but employment and inventories should move lower. Finally, the price index is likely to register a pullback this month.

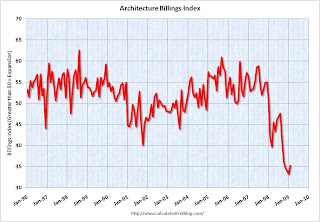

* We forecast a 0.5% decline in February construction spending. The housing starts data suggest that construction activity may have received some temporary support from unseasonably mild weather conditions across parts of the country. So, we look for a much smaller decline in spending than seen in recent months. Renewed weakness in homebuilding and a more rapid pace of decline in non-residential activity should be evident in the coming months. Finally, we don’t expect to see any noticeable support for public infrastructure spending tied to the recently enacted fiscal stimulus legislation until the second half of the year.

* Motor vehicle sales hit a 28-year low of 9.1 million units in February. Anecdotal reports suggest that the sales environment remained miserable in March, and we look for a little changed 9.0 million unit sales rate.

* As foreshadowed by the durable goods data, we look for a sharp 1.9% rise in February factory orders combined with a significant downward revision to January. Meanwhile, shipments are likely to show little change. Inventories are expected to slip 0.7%, with the I/S ratio ticking down a tenth to 1.45 after a major prior run-up.

* We look for a 700,000 drop in March non-farm payrolls. The readings on both initial and continuing unemployment claims are still pointing to a steady deterioration in labor market conditions. However, we actually expect to see an even steeper drop in jobs this month relative to the 650,000 or so declines that were posted in each of the first two months of the year. In particular, we look for some restraint tied to weather-related influences. Although conditions appear to have been near normal during the March survey period, this follows on the heels of much milder than usual weather in February. So, we suspect that favorable weather may have helped to prop up employment in February and this effect could be unwound in March. But any swing to the downside is likely to be tempered by the impact of concurrent seasonal adjustment (a statistical technique that has been used for the past five years or so). Interestingly, all of the large net downward adjustment to the December and January payroll figures in last month’s report was attributable to revised seasonals. The unadjusted figures were actually pushed up a bit. Thus, concurrent seasonal adjustment helped to push up the February reading and offset this by lowering the results for the prior two months. The smoothing process that results from concurrent seasonal adjustment is one reason why the declines in payroll employment seen to this point have not been even larger. Finally, the unemployment rate should continue to move substantially higher to 8.5% from 8.1% (note: we still look for a 9.9% peak by year-end)."