Sudden Debt uses Schrodinger's Cat to help us understand the economy:

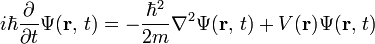

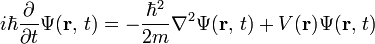

"Today, an oblique homage from the dismal science (economics) to Erwin Schrodinger, a

real scientist. As you may recall, he was the quantum physicist who discovered the eponymous equation (

simplified version below).

Schrodinger's Equation For A Single Particle In Three Dimensions

Schrodinger's Equation For A Single Particle In Three Dimensions'

It does help, if you want to understand an equation, to know what the symbols stand for:

"The Schrödinger equation takes several different forms, depending on the physical situation. This section presents the equation for the general case and for the simple case encountered in many textbooks.

[edit] General quantum system

For a general quantum system:

-

where

-

[edit] Single particle in three dimensions

For a single particle in three dimensions:

-

where

-

is the particle's position in three-dimensional space,

is the particle's position in three-dimensional space, is the wavefunction, which is the amplitude for the particle to have a given position r at any given time t.

is the wavefunction, which is the amplitude for the particle to have a given position r at any given time t.- m is the mass of the particle.

is the potential energy of the particle at each position r.

is the potential energy of the particle at each position r.

If you really want to see how this is derived, be my guest. At least you can see what the terms of reference are.

"Are we having fun yet? Is this gibberish not what you signed up for when you clicked on Sudden Debt today? Do try to hold on, however, because Mr. Schrodinger most famously also devised the well-known

cat-in-the-box thought experiment - and that's our topic today. (After a fashion, anyway...).

Just like the cat inside the box, is the US economy currently dead or alive? Does it follow quantum mechanics, meaning that the two states are superimposed and the economy is

both dead and alive? Finally, does the mere act of observing the state of the economy affect the outcome?"

I love this picture. Now, I want to deviate a second to talk about what I've always wondered about this thought experiment. Would it have been as famous as it is had it been Schrodinger's Aunt in the box? Or would that have been too gruesome? How about Schrodinger's Orchid? Or Schrodinger's Bacteria? I've always wondered if the cat is the basis of the fame of this thought experiment, not the ideas it purports to explain.

"To further illustrate the putative incompleteness of quantum mechanics Schrödinger applied quantum mechanics to a living entity that may or may not be conscious. In Schrödinger’s original thought experiment he describes how one could, in principle, transform a superposition inside an atom to a large-scale superposition of a live and dead cat by coupling cat and atom with the help of a ‘‘diabolical mechanism.’’ He proposed a scenario with a cat in a sealed box, where the cat's life or death was dependent on the state of a subatomic particle. According to Schrödinger, the Copenhagen interpretation implies that the cat remains both alive and dead until the box is opened.

"Schrödinger did not wish to promote the idea of dead-and-alive cats as a serious possibility; quite the reverse: the thought experiment serves to illustrate the bizarreness of quantum mechanics and the mathematics necessary to describe quantum states. Intended as a critique of just the Copenhagen interpretation—the prevailing orthodoxy in 1935—the Schrödinger cat thought experiment remains a topical touchstone for all interpretations of quantum mechanics; how each interpretation deals with Schrödinger's cat is often used as a way of illustrating and comparing each interpretation's particular features, strengths and weaknesses."

In other words, Schrodinger was attempting to show how preposterous certain features of Quantum Mechanics were in his opinion. The cat was not really both alive and dead. QM violated our notions of common sense.

Let me really freak you out, and show you my view:

"In the

many-worlds interpretation of quantum mechanics, which does not single out observation as a special process, both alive and dead states of the cat persist, but are

decoherent from each other. In other words, when the box is opened, that part of the universe containing the observer and cat is split into two separate universes, one containing an observer looking at a box with a dead cat, one containing an observer looking at a box with a live cat.

Since the dead and alive states are decoherent, there is no effective communication or interaction between them. When an observer opens the box, they become entangled with the cat, so observer-states corresponding to the cat being alive and dead are formed, and each can have no interaction with the other. The same mechanism of quantum decoherence is also important for the interpretation in terms of Consistent Histories. Only the "dead cat" or "alive cat" can be a part of a consistent history in this interpretation.

Roger Penrose criticizes this:

"I wish to make it clear that, as it stands this is far from a resolution of the cat paradox. For there is nothing in the formalism of quantum mechanics that demands that a state of consciousness cannot involve the simultaneous perception of a live and a dead cat".[6]

although the mainstream view (without necessarily endorsing many-worlds) is that decoherence is the mechanism that forbids such simultaneous perception."

I also believe in this:

"Modal realism is the view, notably propounded by

David Lewis, that

possible worlds are as real as the actual world. It is based on the following notions: that possible worlds

exist; possible worlds are not different in kind to the actual world; possible worlds are

irreducible entities; the term "actual" in "actual world" is

indexical."

Anyway, let's get back to the economy:

"Let's start from the latter: yes, observation

does affect the economy - if the observer is a presumed expert like the Fed Chairman or the NBER, whose dicta carry considerable weight. (Well, not so much their actual

looking at the economy as what they

say about it - the analogy with quantum physics is not perfect, but you get the point.) More significant is the fact that they

have to look at the economy and they

have to pass judgment on its health. Unlike the physicist running the cat experiment, these experts are

obligated to look inside the box and thus collapse the superimposed states into one."

Remember, the thought experiment was meant to render the cat being alive and dead simultaneously preposterous. I think that this position would be better labeled The Copenhagen Interpretation Of The Economy, but I'm not sure. Anyway, I think that I agree. Human Agency effects the economy. Anthony Giddens has written quite a bit about this subject.

"Currently, every expert has quite apparently looked at the economy and pronounced it dead. In fact, the NBER just post-dated their death certificate and now says that the recession started a full year ago, in December 2007. Could it be that the dismal scientists are currently attempting to convince us that the worst is already behind us? I mean, how can one constantly observe a cat and only decide today that it died a year ago, hoping that the pronouncement will bring it to life tomorrow? The mind boggles... even quantum mechanics doesn't allow for such cavalier treatment of time."

Here's Justin Fox on this:

"What took the committee so long? I'm pretty sure it had nothing to do with any disagreement over

whether we're in a recession. It was all about picking the right starting date. On Friday, the committee's seven members (an eighth, Christina Romer, quit last Tuesday after President-elect Obama

picked her to be chairman of his Council of Economic Advisers) had a conference call and decided on December 2007. As the committee's chairman, Stanford economics professor Robert Hall,

told me almost exactly a year ago:

We don't usually have a conference call until we are quite convinced that a turning point has occurred. Thus the subject of the call is not whether the recession has begun or ended, but rather when that event occurred. Consequently, the call occurs long after it is generally recognized that a turning point has occurred. There is usually a period of 6 months or so when the financial press excoriates us for tardy action."

I didn't post on this precisely because it's simply a dating issue. I didn't think that it meant anything.

"For my money, the economy is still inside the box - it is still both dead and alive. Some dead sectors (finance, real estate) are superimposed upon some others that are very much alive (alternative energy, organic farming/food). Yet other sectors are both dead and alive at the same time, like the auto industry which is dead at the combustion engine end, while being reborn at the plug-in hybrid end.

There is opportunity around, that's for sure. Just make sure that your money's on the right cat."

That sounds like Creative destruction. In my mind, the economy is organic, hence, it is always alive. But let me ask you: Would it have been fine to say, "Just make sure that your money's on the right aunt, orchid, or bacteria? Maybe it would. Certainly it is in some worlds.

Looking at the charts, we observe that both industries had been on a more or less continuous uptrend since 1990-92 - until they jumped off the cliff in 2007. What happened? It's quite simple, really: houses and autos are the #1 and #2 most significant purchases people make in their lifetimes, usually financing both ( TRUE ). That's where easy-easier-easiest credit came in: in just a few years household debt as a percentage of GDP jumped from 67% to nearly 100% (see chart below).

Looking at the charts, we observe that both industries had been on a more or less continuous uptrend since 1990-92 - until they jumped off the cliff in 2007. What happened? It's quite simple, really: houses and autos are the #1 and #2 most significant purchases people make in their lifetimes, usually financing both ( TRUE ). That's where easy-easier-easiest credit came in: in just a few years household debt as a percentage of GDP jumped from 67% to nearly 100% (see chart below). In other words, between 2000 and 2007 we over-borrowed and over-spent on houses and cars, satisfying future demand for many years to come. No matter how low the Fed takes its rates (a record low 0.0% - 0.25% as of yesterday), people are not going to rush to borrow to buy such big-ticket, long-lasting items anytime soon. They do not need them, because they've already bought them. It follows that household lending - the driving force behind finance in recent years - is also going to be down on its heels for many years ( TRUE ).

In other words, between 2000 and 2007 we over-borrowed and over-spent on houses and cars, satisfying future demand for many years to come. No matter how low the Fed takes its rates (a record low 0.0% - 0.25% as of yesterday), people are not going to rush to borrow to buy such big-ticket, long-lasting items anytime soon. They do not need them, because they've already bought them. It follows that household lending - the driving force behind finance in recent years - is also going to be down on its heels for many years ( TRUE ).

is the

is the  is the Reduced Planck's constant, (

is the Reduced Planck's constant, ( is the

is the

is the particle's position in three-dimensional space,

is the particle's position in three-dimensional space, is the wavefunction, which is the amplitude for the particle to have a given position r at any given time t.

is the wavefunction, which is the amplitude for the particle to have a given position r at any given time t. is the potential energy of the particle at each position r.

is the potential energy of the particle at each position r.