"By Mark Pittman

Jan. 10 (Bloomberg) -- Henry Paulson’s bank bailouts, done under “great stress” during the worst financial crisis since the Great Depression, failed to win for U.S. taxpayers what Warren Buffett received for his shareholders by investing in Goldman Sachs Group Inc.( TRUE )

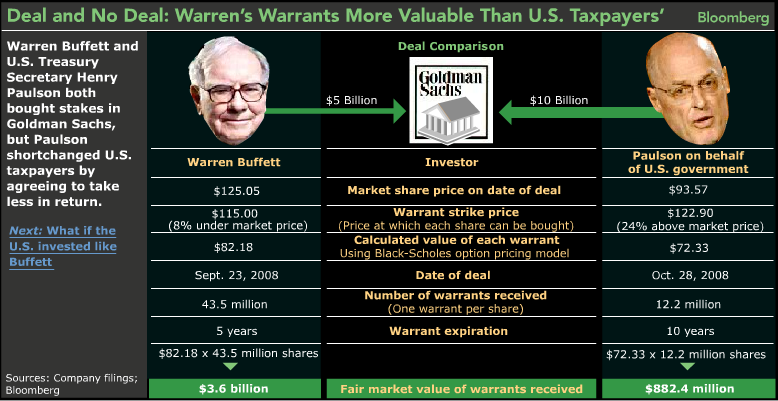

The Treasury secretary made 174 purchases of banks’ preferred shares that include warrants to buy stock at a later date. While he invested $10 billion in Goldman Sachs in October, twice as much as Buffett did the month before, Paulson gained certificates worth one-fourth as much as the billionaire, according to data compiled by Bloomberg. The Goldman Sachs terms were repeated in most of the other bank bailouts.( A DISGRACE )

Paulson’s decisions to prop up the financial system included purchasing shares in institutions from Goldman Sachs, the most profitable Wall Street firm last year, to Saigon National Bank, a Westminster, California, lender whose market value is $3.8 million.

“We were not looking to replicate one-off private deals” in the transactions, made under the $700 billion Troubled Asset Relief Program, Paulson said in a Bloomberg TV interview yesterday.( I ARGUE JUST THE OPPOSITE )

“The market was under great stress and the private sector was extracting very, very severe terms( IT WAS THE OTHER WAY AROUND! ). What we were attempting to do, which I think we did successfully, was design a program that would be accepted by a large group of healthy banks( ? ) with terms that would replicate what you would get in normal market conditions,” he said.

‘20-20 Hindsight’

“With 20/20 hindsight,” the bank-capital injections have achieved their objectives and the decisions on TARP will “prove to be the right ones,” the Treasury secretary said.( HUH? )

Paulson’s warrant deals may give taxpayers less profit from any recovery in financial stocks than shareholders such as Goldman Sachs Chief Executive Officer Lloyd Blankfein and Saudi Arabian Prince Alwaleed bin Talal, owner of 4 percent of Citigroup Inc., said Simon Johnson, former chief economist for the International Monetary Fund.

The transactions are “just egregious,” said Johnson, a fellow at the Peterson Institute for International Economics in Washington. “You want to do it the way Warren does it.”( OBVIOUSLY )

Paulson said “he had to make it attractive to banks, which is code for( COLLUSION ) ‘I’m going to give money away,’” said Joseph Stiglitz, who won a Nobel Prize in 2001 for his work on the economic value of information.

‘Giveaway’

“The worst aspect of this is that they were designed not to do what they were supposed to do,” he said in a telephone interview from Paris Jan. 7. “In many ways, it’s not only a giveaway, but a giveaway that was designed not to work.”( TRUE )

The Treasury would have held warrants for 116 million shares of Goldman Sachs under Buffett’s terms, which would be equivalent to a 21 percent stake when added to those currently outstanding. Instead, the dilution is 2.7 percent under the Treasury plan. Blankfein is the company’s biggest individual investor, with 2.08 million shares worth about $178 million today, according to Bloomberg data. His 0.47 percent interest would have declined to 0.36 percent under Buffett’s terms and would be 0.44 percent if the Treasury’s warrants were exercised.

Senator Judd Gregg, a New Hampshire Republican, estimated in a Jan. 4 Wall Street Journal opinion article that TARP investments have earned about $8 billion while recapitalizing the banking system.

Changes to TARP

Government agencies have committed more than $8.5 trillion to shoring up the financial system, including TARP, signed into law Oct. 3 by President George W. Bush. The program was sold to Congress as a way to buy securities that had fallen in market value. Paulson shifted his emphasis to direct capital injections to banks to prevent the financial sector from foundering.( NOT ACCEPTABLE. BAIT AND SWITCH. )

The House Financial Services Committee and TARP Congressional Oversight Panel plan hearings on how federal bailout money will be used during the administration of President-elect Barack Obama. The financial services panel scheduled its meeting for Jan. 13.

The oversight panel has contracted an independent analyst to examine the terms of TARP investments and is scheduled to deliver a report by Jan. 30, said Elizabeth Warren, chairwoman of the oversight panel, in an interview today. The question matters, Warren said, because shareholders are now being protected by taxpayer dollars.

“Supporting equity is such a profound shift in American economic policy that we must take a hard look at that decision( A GOOD IDEA ),” said Warren, a Harvard Law School professor who specializes in bankruptcy.

‘Something Worth Nothing’

Stiglitz said finance professionals at Treasury possessed expertise on warrant pricing that members of Congress didn’t. As a result, Paulson gave lip service to the lawmakers’ intent on TARP without gaining much value for taxpayers, said Stiglitz, a Columbia University professor who described the pricing mechanism as “a gimmick to make sure that they were giving away something worth nothing.”( I AGREE )

“If Paulson was still an employee of Goldman Sachs and he’d done this deal, he would have been fired,” he said.

A $5 billion U.S. loan last week to GMAC LLC, the Detroit- based finance affiliate of General Motors Corp., was made under the Treasury program and was part of $6 billion advanced to keep the automaker afloat.

In advancing the $5 billion, Paulson accepted warrants that reward taxpayers with an additional $250 million, or 5 percent of the stake. That compares with 15 percent on the 174 completed bank rescues as well as the 100 percent Berkshire Hathaway Inc. Chairman Buffett obtained on an investment in Goldman Sachs in September, Bloomberg data show. A warrant is a company-issued certificate that represents an option to buy a certain number of shares at a specific price by a predetermined date.

‘Stronger Terms’

“You’d certainly hope that the trend would be in the other direction, for stronger terms,” said Rep. Scott Garrett, a New Jersey Republican on the House Financial Services panel, in a telephone interview Dec. 26. “I don’t buy the methodology that they have to be circumspect to protect the parties involved. Ultimately their position has to be to protect the American taxpayer( CORRECT ).”

While the government has pledged to recover its investments, Congress provided little guidance on how to accomplish that. Legislation mandated that the Treasury receive warrants to acquire shares in companies tapping the program to potentially reward taxpayers. The law didn’t specify how many warrants or how they should be priced, factors that will determine how much money, if any, taxpayers get in exchange for their risk.

Buffett’s Warrants

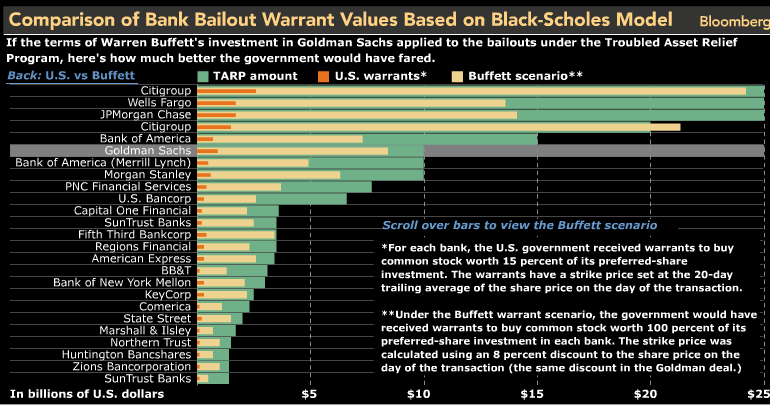

The government has received warrants valued at $13.8 billion in the 25 biggest capital injections from TARP, according to Bloomberg data. Under the terms Buffett negotiated for his $5 billion stake in Goldman Sachs, the TARP certificates would have been worth $130.8 billion.( PLEASE DON'T TELL ME THAT. )

Buffett received 43.5 million Goldman Sachs warrants valued at $82.18 apiece on the date of the transaction, or $3.6 billion, Bloomberg analytics show. Paulson, who served as the New York- based bank’s chief executive officer until 2006, injected twice as much taxpayer money into Goldman Sachs a month later and got 12.2 million warrants worth $72.33 each, or $882 million.

If the Treasury had received the same terms as Buffett, taxpayers would have become the biggest investors in most of the bailed-out banks and existing stakes( COLLUSION ) would have been diluted, Bloomberg data show.

No Confidence

“I halfway believed that the taxpayers would make money in September, but I really don’t believe it now,” Rep. Brad Miller, a North Carolina Democrat on the House Financial Services committee, said in a telephone interview last month.

“We have to have confidence in Treasury to run the program in a way that protects taxpayers, and there’s very little in the way they’ve run it that inspires confidence( TRUE ),” he said.

Congress left it to Paulson and his staff to decide how warrants would be priced and how many the U.S. would receive under the TARP, according to Caleb Weaver, a spokesman for the program’s oversight board. Treasury imposed identical terms for 140 capital injections. Thirty-four closely held lenders issued certificates to the government for preferred stock instead of common shares and one community development institution wasn’t required to issue warrants, according to the Jan. 6 Treasury report on TARP.

Bailouts for American International Group Inc., GMAC, GM and the second of two infusions into Citigroup were reported separately in the Treasury statistics.

‘Not Day Traders’

Paulson and former Goldman Sachs banker Neel Kashkari, who runs TARP as the interim assistant secretary of the Treasury for financial stability, have said the bank bailout will pay off.

“We’re not day traders, and we’re not looking for a return tomorrow( YOU SHOULD BE LOOKING FOR THE BEST DEAL GENIUS. ),” Kashkari told a Mortgage Bankers Association conference on Dec. 5 in Washington. “We are looking to try to stabilize the financial system, get credit flowing again, and over time, we believe that the taxpayers will be protected and have a return on their investment.”

Jackie Wilson, a spokeswoman for Omaha, Nebraska-based Berkshire Hathaway, didn’t respond to e-mail and telephone messages seeking comment. Goldman Sachs spokesman Michael DuVally declined to comment, as did Citigroup spokesman Michael Hanretta.

Paulson left money on the table in three ways, according to economist Johnson:( 1 ) accepting fewer warrants than Buffett did;( 2 ) setting the certificates’ price trigger, or strike, above market values; and( 3 ) receiving an annual yield on the preferred shares that is half of what Buffett will get for the first five years.

Dividend Payments

The government will forgo almost $48 billion over the next five years in preferred stock dividend payments from the 25 biggest TARP infusions, as compared with Buffett, according to the terms of the deals.

Buffett’s five-year warrants for 43.5 million shares of Goldman Sachs were valued at $82.18 each using the Black-Scholes option pricing model developed by Fischer Black and Myron Scholes to estimate the fair market value of such contracts. The model uses, among other data, the implied price volatility of the underlying security. The Treasury received 10-year warrants for 12.2 million Goldman shares priced at $72.33 on Oct. 28 using the same method.

The taxpayers’ certificates were set at the 20-day trailing average of the share price, which for Goldman Sachs was $122.90 on Oct. 28, when the company closed almost $30 cheaper at $93.57. The trailing average ensured a higher strike price, and lower value for the warrants, because bank stocks were plummeting.

8 Percent

By contrast, Buffett received an 8 percent discount to the market price at $115 a share on Sept. 23, when the stock closed at $125.05.

Taxpayers also acquired preferred shares as part of the bailout. These securities, which can’t vote unless the issue at hand is the creation of a more senior preferred stake, carry an interest payment of 5 percent that increases to 9 percent in five years. Buffett’s preferred shares in Goldman Sachs pay a 10 percent yield.

If Goldman Sachs rises to its five-year average price of $147, Buffett will be able to profit by $1.4 billion from exercising his warrants. The government warrants will be in the money for $294 million, or about a fifth as much for twice the investment.( COME ON )

TARP was set up to recapitalize banks and other financial institutions that lost money on subprime mortgages and commercial lending. It allocated $125 billion to nine of the largest banks and securities firms, and then invited all banks or savings and loans to apply for part of another $125 billion.

Saigon National

Recipients range from JPMorgan Chase & Co. in New York, which got $25 billion, to Saigon National, which received $1.2 million.

The government plans billions more in cash injections to companies including credit-card networks Discover Financial Services and American Express Co.

Under Buffett’s terms, the Treasury’s investment in Citigroup would also have brought greater potential for profit to taxpayers. The two cash infusions totaling $45 billion would have resulted in warrants for about 5.6 billion shares, which would more than double the 5.4 billion of existing shares. The Treasury’s warrants call for 464 million shares, or 8 percent of the number under Buffett’s terms.

None of the bank warrants for the biggest 25 capital injections from TARP funds can be exercised profitably now. Goldman Sachs closed in New York Stock Exchange composite trading at $83.92 yesterday, 32 percent less than its $122.90 strike price. Citigroup closed at $6.75, or 62 percent less than its highest exercise price of $17.85.

Exercising Warrants

Four of the 25 bank warrants could be exercised in the next year, based on Bloomberg surveys of analysts’ 12-month share- price forecasts. The average projection for Morgan Stanley at $26.46 is more than $3 higher than its strike price.

Analysts also expect American Express Co., Bank of New York- Mellon Corp. and the second capital injection for SunTrust Banks Inc. to rise above their strike prices, according to the surveys.

Congress may have another chance to get money back. The TARP legislation includes a requirement that lawmakers find a way in five years for taxpayer losses to be recouped from the financial industry.

To contact the reporter on this story: Mark Pittman in New York at mpittman@bloomberg.net."

I said at the time that it was a disgrace.Now, in graphic form, from The Big Picture:

"Earlier this morning, we discussed how badly the Treasury department, along with Congress, had bungled the bailout monies.

These two graphics show exactly what an awful deal the taxpayer got for our monies.

Buffett’s Better Deal

>

Source:

Paulson Bank Bailout in ‘Great Stress’ Misses Terms Buffett Won

Mark Pittman

Bloomberg, Jan. 10 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aAvhtiFdLyaQ&"