"Milton Friedman Would Have Welcomed the Fed's Intervention in Bear Stearns 8 comments

Peter Goodman of the New York Times writes that Milton Friedman "would surely be unhappy with this turn" of events as the Federal Reserve intervenes in financial markets to cushion the impact of things like the collapse of Bear Stearns (BSC).

No, Peter Goodman, you are wrong. Friedman would have welcomed the Fed's intervention in Bear Stearns as a way of preventing a downward move in the deposit-currency ratio and thus a fall in the money stock.

On a deeper level, I really think that Peter Goodman of the New York Times gets Milton Friedman wrong. Milton Friedman said that prosperity springs from markets as long as:

- The government is not allowed to establish and maintain islands of monopoly power.

- The government stabilizes the money stock and keeps the economy liquid--keeps the stock of assets people can readily spend growing at a steady pace.

Had Peter Goodman actually read anything Milton Friedman wrote about the Great Depression, Goodman would know that when Milton Friedman "attributed the worst economic unraveling in American history to regulators," he placed special stress on Depression-era regulators' refusal to move aggressively to handle bank failures--in Friedman and Schwartz's The Great Contraction, the moment when a normal recession becomes the Great Depression comes about when the Bank of United States fails and the Federal Reserve refuses to step in to handle the situation. Friedman was very much pro-bailout as far as bank depositors were concerned when a failure to do so would lead to a systemic reduction in the money stock.

And Friedman's line was always not that market are perfect, but rather that while markets can and do fail governments have more common and worse modes of failure--except for a narrow range of core functions: rule of law, systemic financial stability, increasing-returns infrastructure, et cetera.

There are tens of thousands of people--left, right, and center--who know Milton Friedman's work, and who would not have committed the elementary error of writing "Friedman... would surely be unhappy with this turn" of government--chiefly the Federal Reserve--working to contain and stem the current financial crisi.

So why is ink given to Peter Goodman, far out of his depth? Why oh why can't wett have a better press corps?

Reconsidering Milton Friedman's Legacy: A Fresh Look at the Apostle of Free Markets: Joblessness is growing. Millions of homes are sliding into foreclosure. The financial system continues to choke on the toxic leftovers of the mortgage crisis. The downward spiral of the economy is challenging a notion that has underpinned American economic policy for a quarter-century — the idea that prosperity springs from markets left free of government interference. The modern-day godfather of that credo was Milton Friedman, who attributed the worst economic unraveling in American history to regulators, declaring in a 1976 essay that “the Great Depression was produced by government mismanagement.”...

Just as the Depression remade government’s role in economic life, bringing jobs programs and an expanded welfare system, the current downturn has altered the balance. As Wall Street, Main Street and Pennsylvania Avenue seethe with recriminations, a bipartisan chorus has decided that unfettered markets are in need of fettering. Bailouts, stimulus spending and regulations dominate the conversation. In short, the nation steeped in the thinking of a man who blamed government for the Depression now beseeches government to lift it to safety. If Mr. Friedman, who died in 2006, were still among us, he would surely be unhappy with this turn....

Mr. Friedman’s brand of libertarianism rested on the assumption that economic and political freedom were one and the same. It meshed with and fed the cold war thinking of his time, as the United States offered up capitalism as liberty itself in contrast to the authoritarian Soviet Union. Among professional economists, Mr. Friedman’s analytical mastery was near-universally admired.... His greatest contribution came the following decade, when Mr. Friedman dismantled the consensus view that inflation was a tolerable byproduct of high employment. He demonstrated that high inflation would eventually cost jobs, as businesses were discouraged to invest by the higher wages they had to pay.

“This triumph, more than anything else, confirmed Milton Friedman’s status as a great economist’s economist, whatever one may think of his other roles,” Paul Krugman, an economist (and a New York Times columnist) wrote last year in The New York Review of Books.

Mr. Friedman captured the era with a new formulation known as monetarism: that the government should gradually and predictably inject cash into the financial system, and then let the market figure out where it should go. “Any honest Democrat will admit that we are now all Friedmanites,” Lawrence H. Summers, the Harvard economist and former Clinton administration Treasury secretary, wrote in an appreciation published in this newspaper when Mr. Friedman died. “He has had more influence on economic policy as it is practiced around the world today than any other modern figure”...

Paul Krugman has his own complaint about Goodman:

Paul Krugman: [O]n behalf of economists everywhere, I want to protest about [Goodman's] description of [Friedman's] natural rate hypothesis:

He demonstrated that high inflation would eventually cost jobs, as businesses were discouraged to invest by the higher wages they had to pay.

This is deeply unfair to Friedman -- it makes a quite profound insight sound like nothing more than a rant.

Here's how I described the natural rate hypothesis in the NYRB piece:

He argued that after a sustained period of inflation, people would build expectations of future inflation into their decisions, nullifying any positive effects of inflation on employment. For example, one reason inflation may lead to higher employment is that hiring more workers becomes profitable when prices rise faster than wages. But once workers understand that the purchasing power of their wages will be eroded by inflation, they will demand higher wage settlements in advance, so that wages keep up with prices. As a result, after inflation has gone on for a while, it will no longer deliver the original boost to employment. In fact, there will be a rise in unemployment if inflation falls short of expectations.

What would Friedman be thinking now, if he were still alive? He would be worried about regulatory overreach. He would be conflicted because he would also be well-aware that organizations capable of generating systemic risk need to be regulated in some way in order to diminish the scope for moral hazard (hence Friedman's calls, at times, for extremely strict banking regulation: 100% reserve banking, in fact).

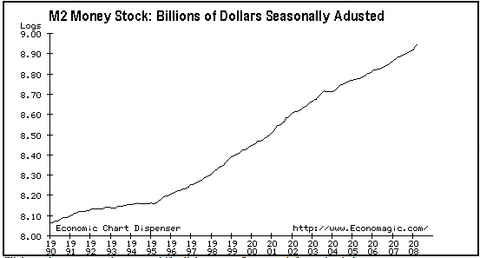

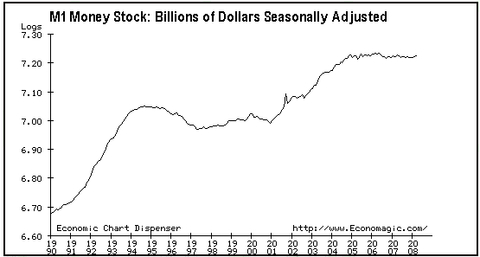

He would mostly, however, be focused on two graphs of the behavior of the money stock:

And he would have been approving of Federal Reserve policy as long as it kept both these lines from either (a) falling or (b) exploding upward."

No comments:

Post a Comment