"The fiscal black hole in the US

June 12, 2009 3:00am

US budgetary prospects are dire, disastrous even. Without a major permanent fiscal tightening, starting as soon as cyclical considerations permit, and preferably sooner, the country is headed straight for a build up of public debt that will either have to be inflated away or that will be ‘resolved’ through sovereign default.

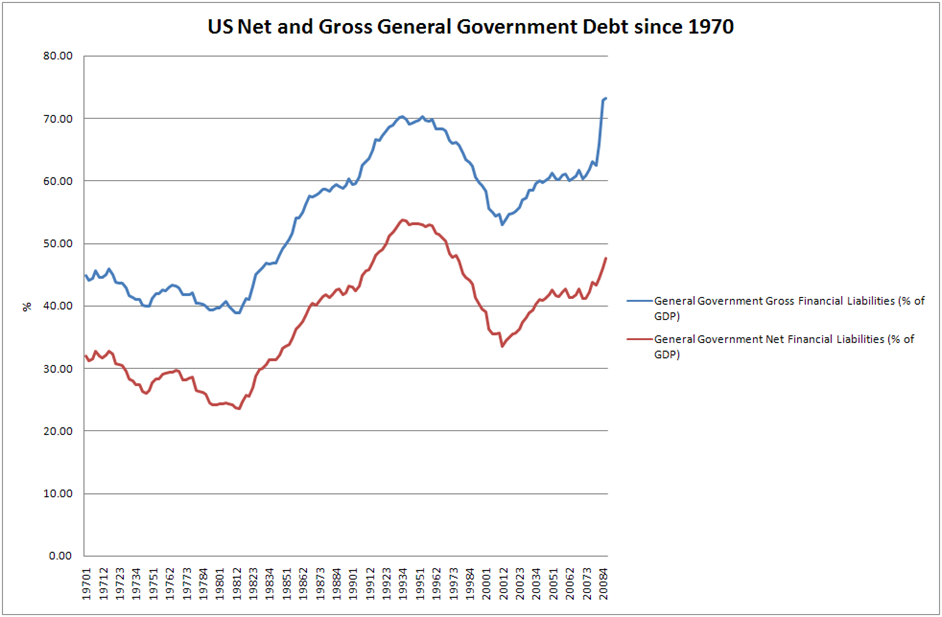

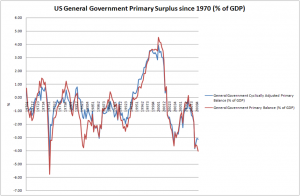

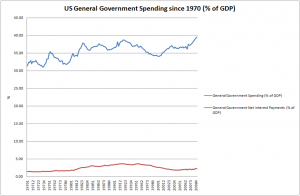

The dynamics of US general government (Federal, State and Local) public debt since 1970 is shown in Figures 1 and 2 below. They show the fiscal irresponsibility of the George W. administrations; fiscal policy was relentlessly procyclical, with the sizeable primary surpluses of the Clinton years blown away in a series of regressive tax cuts. Figure 3 shows that, even before the economic downturn started raising the numerator and lowering the denominator of public spending as a share of GDP (from the second quarter of 2008), general government expenditure had been growing faster than GDP during most of the George W. years (all three figures are based on OECD data).

Figure 1

Figure 2

Figure 3

US general government debt relative to GDP is now just above the level of the Euro Area - 73.0% for the US at the end of 2008 as opposed to 69.3% for the Euro Area. Public spending as a share of GDP in the US (38.7% for 2008) was still eight percentage points lower than in the Euro Area (46.7%). As the US entered the downturn 2 or 3 quarters before the Euro Area, the cyclically corrected difference is public spending programme size is likely to be even larger.

Even if we ignore the relentless build-up of public outlays through the social security programmes and especially through the Medicaid and Medicare programmes, the extraordinary levels predicted for the US Federal deficit for the next couple of years (13 to 14 percent of GDP for the next year and not much less for the year after that), plus the cost of recapitalising the banks, shoring up other wonky bits of the financial system and intervening to bail out rust-belt behemoths like GM and Chrysler are likely to put the general government gross debt to GDP ratio at well over 100 percent.

Even that, however, is only the beginning. It does not yet include price tag for the laudable ambition of the Obama administration to ensure that no American is without health insurance. Nor does it include planned government outlays for updating America’s clapped-out infrastructure or the pursuit of the environmental agenda. Bringing American secondary education (numeracy, literacy, foreign language skills etc.) up to the levels of the most successful emerging markets will also be very expensive, although more government money is only a necessary condition for significant progress in this area; a major change in the governance arrangements for schools in the incentives faced by teachers, heads, pupils and parents are also necessary. And I cannot really envisage Obama confronting the American Federation of Teachers. Without reform in governance and incentives, even vastly increased public spending on health and education will achieve in the US what it achieved the UK under Labour in the past six years: very little indeed.

So new spending commitments on health, infrastructure, the environment and education will take US general government spending as a share of GDP comfortably over the 40 percent level, even on a cyclically adjusted basis. Even if the US were to recoil from further imperial overstretch and halved military spending as a share of GDP, that only would know 2.5% of the total public spending share.

Then come the famous ‘unfunded liabilities’ of social security, Medicare and Medicaid. There is a bit of abuse of language in the term ‘liabilities ‘here. We are not talking about contractual commitments or legal obligations. We are talking about promises made by politicians and expectations of US citizens shaped by these promises. Unfunded social security liabilities are the “infinite horizon discounted value” of what has already been promised to recipients but has no funding mechanism currently in place. For social security this is $13.6 trillion, slightly less than a year’s worth of US GDP (around $14 trillion).

While big, social security promises are dwarfed by Medicare promises. There are three components to Medicare. Medicare Part A covers hospital stays; its unfunded component has an infinite horizon present discounted value of $34.4 trillion; Medicare B covers doctor visits; its unfunded component is worth $34.0 trillion. Medicare D covers the drugs benefit; its unfunded component amounts to $17.2 trillion. The total unfunded liability for Medicare is $85.2 trillion, just over 600% of US annual GDP. Medicare and social security together have unfunded liabilities worth 700 percent of US annual GDP.

Sure, these numbers are point estimates with wide margins of error. But the potential errors can go either way. In addition, these are, once again, not legal or contractual liabilities, like public debt or pension commitments of the state to its employees. They are promises by the government; hopes and expectations for the public.

It is obvious that these unfunded liabilities of social security and Medicare will be defaulted on. They will not be met in full. The modalities by which the state will renege on these promises and commitments can be partly foreseen based on relevant experience in the UK and elsewhere: failure to index-link social security benefits to earnings or even to the cost of living; rationing of hospital stays and doctors visits; denial of expensive treatments and medication to state-insured patients (beginning with the elderly) etc. etc. But no doubt our political masters will be able to surprise us with the ingenuity of the dodges they will design to ‘default’ on these unfunded liabilities.

To fund all these unfunded commitments, a permanent tax increase or spending cut as a share of GDP would be required equal in magnitude to the unfunded liability as a share of GDP (700 percent) times the excess of the long-term interest rate on the public debt over the long-term growth rate of GDP. Even if that excess were only 1 percentage point, the permanent primary surplus would have to rise by seven percent of GDP. If the excess is 2 percent, the permanent primary surplus would have to rise by 14 percent of GDP. The optimistic case would, if the entire adjustment were to take place through higher taxes, take the US tax burden to the current average level of the Euro Area. If the long-term interest rate is 2 percentage points above the long-term growth rate and the entire adjustment were to occur through taxes, the US would be well on its way to becoming Sweden, at least as regards the tax burden.

Adding Obama’s own new commitments to these unfunded liabilities would raise the necessary permanent increase in the general government primary surplus to at least 10 percentage points of GDP, and possibly 20 percent of GDP.

These figures should not come as a surprise. Obama’s plans for public expenditure are conventional, middle-of-the road social democratic spending plans. You cannot have social democratic spending ambitions if you are not able to impose social democratic tax burdens.

My fears about the sustainability of the US public finances is based on my belief that the US public believes there is a Santa Claus: that you can have the higher benefit levels and higher-quality provision of public goods and services without paying the price in the form of higher taxes or user charges. The US polity is so polarised, that it is not likely that a compromise will be achieved in the years and decades to come, on how to raise the additional revenues or how to cut public spending by enough to restore public debt sustainability. Exaggerating slightly, the Democrats will veto any future public spending cuts and the Republicans will veto any future tax increases.

The result will be a build-up of public debt of such magnitude, that the markets will force the government to choose between inflation and default. The state will choose inflation. It always has done to in the past when the debt burden was exceptionally high. If the state wanted to signal it will not choose inflation, it would retire its dollar-denominated debt and replace is with index-linked debt or foreign-currency denominated debt. There is no sign of this. Indeed, even as regards new debt issues, index-linked debt is hardly on the menu at all. When a commitment device is easily available but is not adopted, I tend to get concerned.

The markets are slowly waking up to the threat of inflation as a solution to fiscal unsustainability in the US. The fact that, in the short run (say for the next 3 years or so) deflation is much more likely than inflation does not help, as markets are hopelessly myopic. But once we get more than 3 years into the future, and certainly more than 5 years, the risk of high inflation (between 5 and 15 percent, say) is a material one. Only if Obama manages to put together a new coalition, based on a new national consensus, about the level of public spending and the distribution of its funding burden, will there be a non-inflationary way out of the debt dilemma. Such a major political realignment is possible, but not likely.

Ten-year rates on Treasury Notes have just begun to tickle 4 percent. Sooner (if markets become less myopic) or later (if markets remain stuck between blindness and myopia) the reality of the future inflationary threat will feed into interest rates at maturities of five years and longer. The Fed will not be able to stop this. It may temporarily be able to check the rise in long rates at those exact maturities it decides to purchase, but it cannot be present continuously at all maturities.

Ultimately, the 10-year rate is driven by expectations of short-term rates (like the Federal Funds rate) over the next 10 years. Sure there are term premia and there may be inflation risk premia (negative or positive) that come between the 10 - year rate and expected future short rates over a 10-year horizon. But expectations dominate. The Fed can only commit itself to a sequence of low future short rates (on average) if it can credibly commit itself to raise future short rates, should it be required to maintain price stability, to whatever level is necessary. But if the fiscal authorities (the Treasury and ultimately the White House) are considered likely to stop the Fed from fighting inflation effectively in the future, because such inflation is deemed necessary by the fiscal authorities to restore fiscal sustainability, then we are likely to see scenario where future short rates rise, as inflationary pressures rise, but not by enough to bring inflation down rapidly. Ex-post real rates will fall, thus achieving the objectives of the fiscal authorities.

The $300bn worth of Treasury securities the Fed has agreed to purchase already are not a threat to price stability - it is peanuts. It does barely enough to offset the reduction in the balance of the Treasury’s account with the Fed since the beginning of the crisis. But as the Federal government starts issuing additional debt worth a couple of trillion US dollars or more each year, the willingness of the Fed to monetise this increased debt issuance will be the key factor determining who will win the game of monetary-fiscal chicken that is just now starting. The independence of the Fed is not securely anchored. A chairman of the Fed who refuses to monetise government debt that the Treasury wants to be monetised, or who wants to de-monetise Federal debt acquired in past quantitative easing episodes when the Treasury does not want the Fed to exit from QE, will be replaced."

Me:"When a commitment device is easily available but is not adopted, I tend to get concerned."

You don't really mean to apply that standard to govt in the real world, do you?

"My fears about the sustainability of the US public finances is based on my belief that the US public believes there is a Santa Claus: that you can have the higher benefit levels and higher-quality provision of public goods and services without paying the price in the form of higher taxes or user charges. "

I don't think that's right. Rather, we feel that we can kick the problem down the road a bit. We're all native Californians, in that sense.

"Only if Obama manages to put together a new coalition, based on a new national consensus, about the level of public spending and the distribution of its funding burden, will there be a non-inflationary way out of the debt dilemma. Such a major political realignment is possible, but not likely."

Maybe it'll be one of those Black Swans everyone's talking about. Apparently, they're more common than had been previously believed. A Grey Swan, perhaps. Instead of Santa Claus, we believe in Grey Tails. By the way, did you consider fat tails in your copulas? Projections?

"It may temporarily be able to check the rise in long rates at those exact maturities it decides to purchase, but it cannot be present continuously at all maturities.

Can I see a proof of that?

"But no doubt our political masters will be able to surprise us with the ingenuity of the dodges they will design to ‘default’ on these unfunded liabilities."

Good. something to look forward to.

It's a Political Problem. I agree.

"They are promises by the government; hopes and expectations for the public."

I'll take belief in Santa before these promises, and I'm Jewish.

No comments:

Post a Comment