"March Economic Summary in Graphs

by CalculatedRisk on 3/31/2009 01:30:00 PM

Here is a collection of 20 real estate and economic graphs for data released in March ...

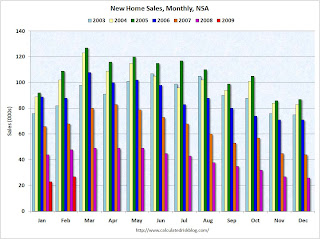

New Home Sales in February

New Home Sales in FebruaryThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2009. This is the lowest sales for February since the Census Bureau started tracking sales in 1963. (NSA, 27 thousand new homes were sold in February 2009; the previous low was 29 thousand in February 1982).

From: New Home Sales: Just above Record Low

Housing Starts in February

Housing Starts in FebruaryTotal housing starts were at 583 thousand (SAAR) in February, well off the record low of 477 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 357 thousand in February; just above the record low in January (353 thousand).

Permits for single-family units increased in February to 373 thousand, suggesting single-family starts could increase in March.

From: Housing Starts Rebound

Construction Spending in January

Construction Spending in JanuaryThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years.

From: Construction Spending: Non-Residential Cliff Diving

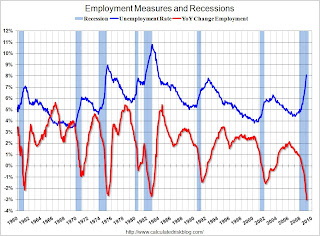

February Employment Report

February Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 651,000 in February. The economy has lost almost 2.6 million jobs over the last 4 months!

The unemployment rate rose to 8.1 percent; the highest level since June 1983.

From: Employment Report: 651K Jobs Lost, 8.1% Unemployment Rate

February Retail Sales

February Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

From: Retail Sales: Some Possible Stabilization

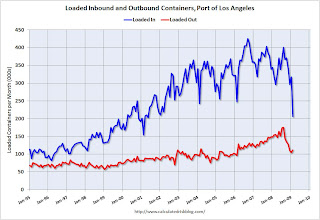

LA Port Traffic in February

LA Port Traffic in FebruaryThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 35% below last February and 35% below last month.

From: LA Port Import Traffic Collapses in February

U.S. Imports and Exports Through January

U.S. Imports and Exports Through JanuaryThis graph shows the monthly U.S. exports and imports in dollars through January 2009. The recent rapid decline in foreign trade continued in January. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

The graph includes both goods and services. The import and export of services has held up pretty well; most of the collapse in trade has been in goods. Imports of goods has declined by one third from the peak of last July!

From: U.S. Trade: Exports and Imports Decline Sharply in January

February Capacity Utilization

February Capacity UtilizationThe Federal Reserve reported that industrial production fell 1.4% in February, and output in February was 11.2% below February 2008. The capacity utilization rate for total industry fell to 70.9%, matching the historical low set in December 1982.

This is a very sharp decline in industrial output.

From: Industrial Production and Capacity Utilization: Cliff Diving

NAHB Builder Confidence Index in March

NAHB Builder Confidence Index in MarchThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

From: NAHB Housing Market Index Still Near Record Low

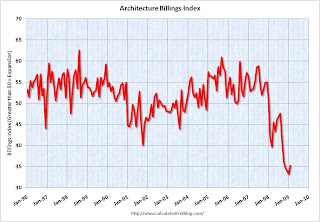

Architecture Billings Index for February

Architecture Billings Index for February"Following another historic low score in January, the Architecture Billings Index (ABI) was up two points in February. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI rating was 35.3, up from the 33.3 mark in January, but still pointing to a general lack of demand for design services (any score above 50 indicates an increase in billings)."

From: Architecture Billings Index Near Record Low

Vehicle Miles driven in January

Vehicle Miles driven in JanuaryBy this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

As the DOT noted, miles driven in January 2009 were 3.1% less than January 2008.

From: DOT: U.S. Vehicle Miles Off 3.1% in January

Existing Home Sales in February

Existing Home Sales in FebruaryThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2009 (4.72 million SAAR) were 5.1% higher than last month, and were 4.6% lower than January 2008 (4.95 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

From: Existing Home Sales Increase Slightly in February

Existing Home Inventory February

Existing Home Inventory FebruaryThis graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 3.8 million in February. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Usually most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

From: Existing Home Sales Increase Slightly in February

Case Shiller House Prices for January

Case Shiller House Prices for JanuaryThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and off 2.5% in January.

The Composite 20 index is off 29.1% from the peak, and off 2.8% in January.

From: Case-Shiller: Prices Fall Sharply in January

Mortgage Equity Extraction for Q4

Mortgage Equity Extraction for Q4Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

From: Q4 Mortgage Equity Extraction Strongly Negative

Unemployment Claims

Unemployment ClaimsThe first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 649,000.

Continued claims are now at 5.56 million - the all time record.

From: Unemployment Insurance: Continued Claims Over 5.5 Million

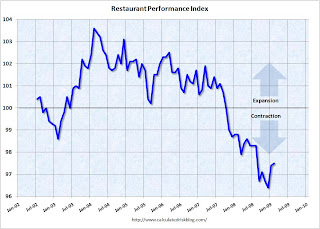

Restaurant Performance Index for February

Restaurant Performance Index for February"Restaurant industry performance remained soft in February, as the National Restaurant Association’s comprehensive index of restaurant activity stood below 100 for the 16th consecutive month. The Association’s Restaurant Performance Index (RPI) ... stood at 97.5 in February, up 0.1 percent from its January level."

From: Restaurant Peformance Index: 16th Consecutive Month of Contraction

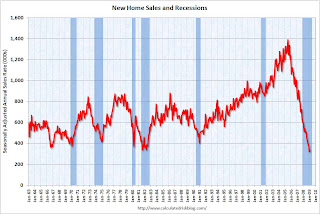

New Home Sales: February

New Home Sales: FebruaryThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.From: New Home Sales: Just above Record Low

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

Philly Fed State Indexes February

Philly Fed State Indexes FebruaryHere is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining activity.

This is the new definition of "Red states".

This is what a widespread recession looks like based on the Philly Fed states indexes.

From: Philly Fed State Indexes: We're all Red States now!

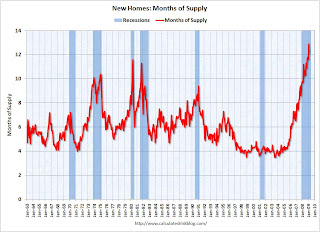

New Home Months of Supply: February

New Home Months of Supply: FebruaryThere were 12.2 months of supply in February - just below the all time record of 12.9 months of supply set in January.

The seasonally adjusted estimate of new houses for sale at the end of February was 330,000. This represents a supply of 12.2 months at the current sales rate.From: New Home Sales: Just above Record Low

No comments:

Post a Comment