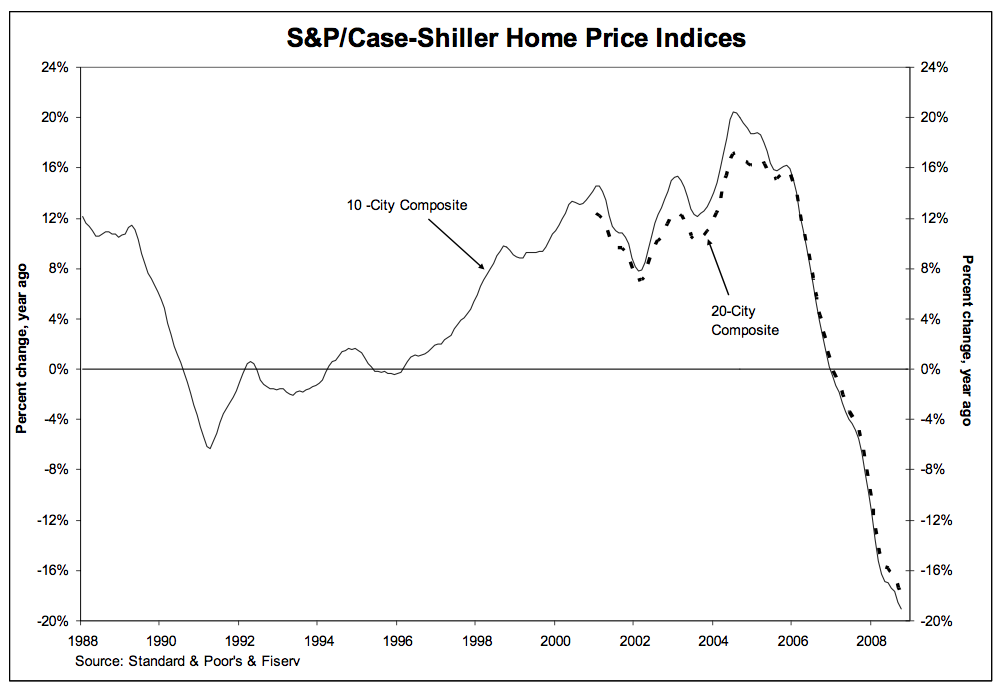

"Home Prices Fall to 2004 Levels; 18% Record Drop

Data through October 2008 shows continued broad based declines in the prices of existing single family homes across the United States, with 14 of the 20 metro areas showing record 10% versus October 2007.

The overall 20 city composite index fell 18% year over year, up from a drop of 17.4% y/o/y in September. The usual culprits led the decline, Vegas, Phoenix, San Francisco, LA, San Diego and Miami. The smallest y/o/y decline was in Charlotte which fell just 4.45%.

Peter Boockvar notes that “While weak but not unexpected, the more interesting data will be seen beginning with the Nov #’s as that is when mortgage rates started its sharp drop. Today in fact, according to Bankrate.com, the average 30 yr mortgage rate reached its lowest level since Sept ‘05 at 5.22%. To this point, the only big reaction to the drop in rates has been in refi’s but it’s purchases that need to be revived and we’ll see hopefully soon if it’s price or cost of money that will drive the buying decision.”

That's a very good question, because I have been pushing for a drop in housing prices of 5 % more. However, we're getting pretty close to that now.

No comments:

Post a Comment