Return of depression economics

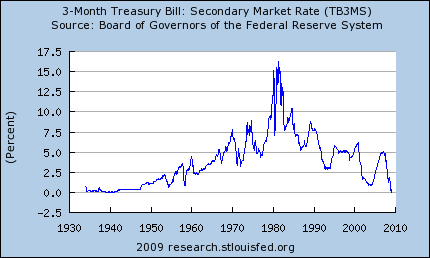

I was alerted to this Media Matters post, revealing that people still don’t get why the current slump is different from the early 1980s, and why fiscal policy is necessary this time. Yes, I know, it’s Joe Scarborough; but still …

Anyway, it’s the zero lower bound, stupid. And here’s the picture to make the point:

Back at the bottom

Back at the bottomMe:

In addition to the stimulus, in order to battle Debt-Deflation, we should do one of the following two things:

http://www.nber.org/~wbuiter/helijpe.pdf

I think that they satisfy this:

“The way to make monetary policy effective, then, is for the central bank to credibly promise to be irresponsible - to make a persuasive case that it will permit inflation to occur, thereby producing the negative real interest rates the economy needs.

This sounds funny as well as perverse. Bear in mind, however, that the basic premise - that even a zero nominal interest rate is not enough to produce sufficient aggregate demand - is not hypothetical: it is a simple fact about Japan right now. Unless one can make a convincing case that structural reform or fiscal expansion will provide the necessary demand, the only way to expand the economy is to reduce the real interest rate; and the only way to do that is to create expectations of inflation.”

Since we really don’t know what will work, such a two-barreled approach is the wiser course.

I also would like a sales tax cut and targeted tax cuts for investment.

— Don the libertarian Democrat

No comments:

Post a Comment