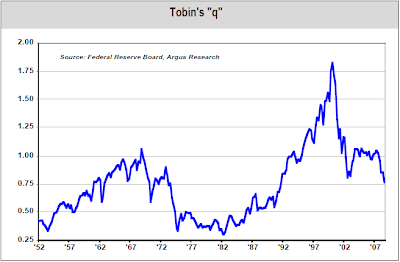

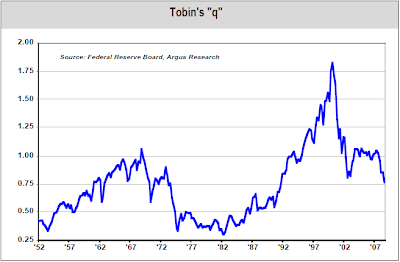

Disciplined Approach To Investing updates us on Tobin's Q:

According to Argus Research Tobin's "q" has reached its lowest level since 1965. Argus notes:

"When the stock market trades at a 'discount' to the replacement cost of its assets, the market is inexpensive, or cheaper to buy than build. This discount possesses ‘q’ ratios that are less than 1.0. Conversely, when “q” exceeds 1.0, the market trades at a premium to its replacement cost. The runup from 1996-2000 had ‘q’ approaching the unthinkable value of 2.0...The long-term average for Tobin’s ‘q’ is 0.76."

Make of it what you will. I'm still not sure.

No comments:

Post a Comment