"Credit Crunch? Look at the Chart, Skip the Article

The NYT has an article promoting the credit crunch story whereby credit worthy businesses are supposedly unable to get credit. Readers would be well-advised to skip the article and just look at the accompanying chart. The chart tells readers that the interest rate on the debt of investment grade corporate debt was pretty much the same in the fourth quarter as it was earlier in the year, and in fact only a small amount higher than it had been in the three preceding years. In other words, investment grade companies are paying pretty much the same interest rate as they always have and probably expected in their planning.

The chart also shows volumes of debt issuance. There was a falloff in issuance of investment grade debt in the third quarter (after a big surge in the second quarter), but the fourth quarter levels are pretty much in line with prior years.

There has been a serious falloff in the issuance of high yield debt as well as surge in the interest rates payable on this debt. That is what happens in recessions. The survival of companies whose survival was always questionable becomes far more questionable in a severe downturn. These companies are in reality far higher risks, so it is understandable that banks would be reluctant to lend to them even if the banks had plenty of capital.

The credit system is undoubtedly facing considerable stress because so many banks are effectively bankrupt, but the economy is not in a downturn because banks aren't lending. It is in a downturn because we have just lost $6 trillion in housing wealth and $8 trillion in stock wealth. The expected effects of this loss of wealth is the huge falloff in consumption that is driving the downturn. The condition of the banks is very much a secondary issue.( HERE'S WHERE I DISAGREE. THE CALLING RUN DOES EFFECT EVERYTHING BECAUSE IT CAUSES A CONTINUING LOSS OF WEALTH, AND EFFECTS THE PROACTIVITY RUN. IN OTHER WORDS, CAUSES PROACTIVE JOB LOSSES. )

--Dean Baker

Here's the chart:

| ||||

"Spreads

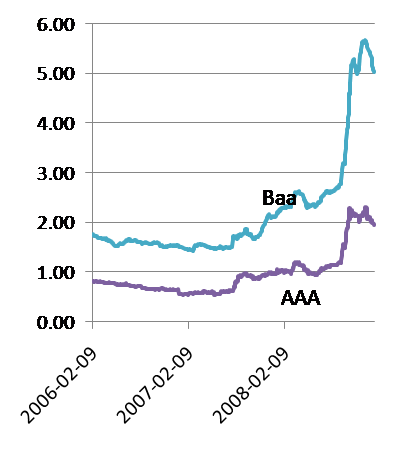

I don’t usually disagree with Dean Baker, but I think he’s wrong here. The really striking thing about corporate borrowing rates isn’t that they’re high by historical standards, although they are, but the fact that they’re high even though interest rates on government debt are very, very low. Below I show the spreads on AAA and Baa debt against 30-year Treasuries: they really have spiked.

Also bear in mind the decline in expected inflation: real corporate rates are very high.

So yes, we do have a credit crunch. It’s not the whole story, but it’s part of the story.

Where I differ with both Krugman and Baker is in being for a tax incentive for investment, which the Obama team had the sense to include on my advice in their stimulus package. Remember, I've been for it since October. Why? We need to attack the fear and aversion to risk. We need people investing in corporate bonds. Unlike Baker, I believe that we want that left chart going up even more. Frankly, it's not a good sign that it's been so flat during this housing boom. I need to look and see if the diversion of investment into housing was a disaster on corporate investment. I don't know off hand.

No comments:

Post a Comment