"We are fond of all manner of sentiment measures, including anecdotal info like this.

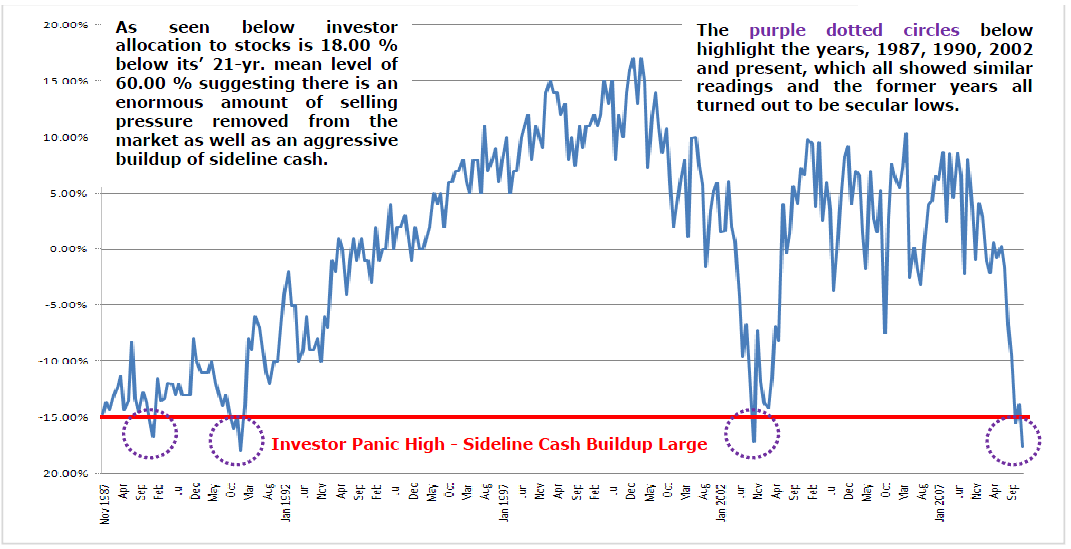

However, we always find ourselves going back to the data. While sentiment surveys produce a chartable data stream, we especially prefer Asset Allocation measures.

This way we not only see what people are saying, but we can measure exactly what they are doing.( EXACTLY. NOW, ASK YOURSELF, HOW HAVE INVESTORS BEEN REACTING TO GOVERNMENT BAILOUTS? WHAT MIGHT THE ASSUMPTIONS AND PRESUPPOSITIONS UNDERLYING THOSE REACTIONS BE?)

>

American Association of Individual Investors (AAII)

Average Asset Allocation Survey

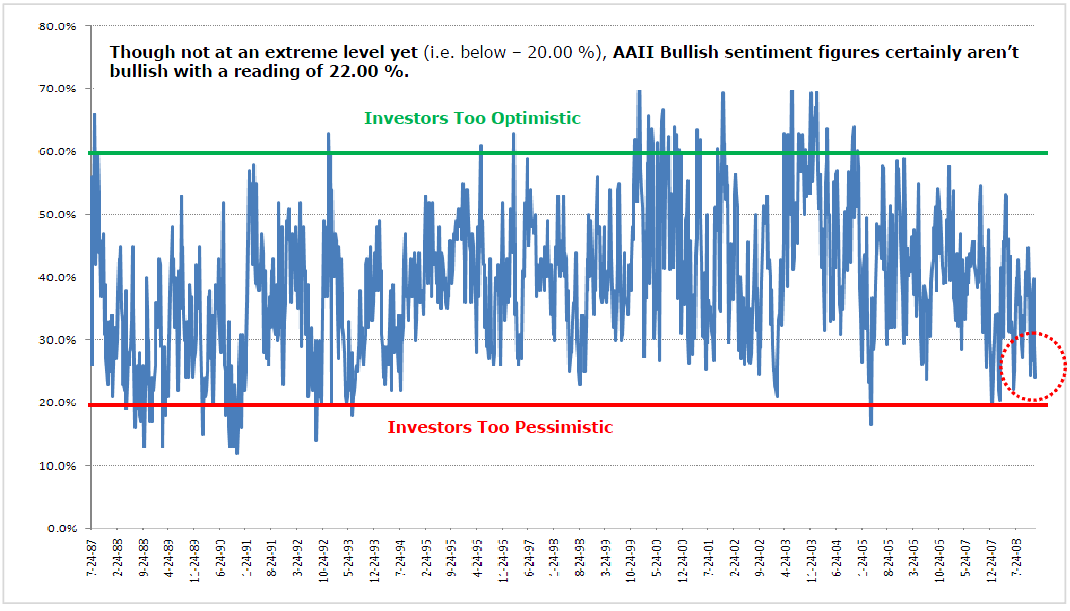

American Association of Individual Investors (AAII)

Bullish Sentiment Survey (Stocks)

Charts courtesy of Fusion IQ

No comments:

Post a Comment