From John Hempton:"

We are not close to being Swedish yet

Nouriel Roubini has a

newspaper article that says we are all Swedish now. I wish it were true. We are nowhere near being Swedish.

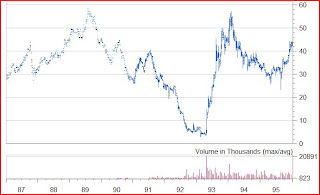

This is an investment blog – so – in tradition of investment blogs I am going to start with a stock chart.

This is a chart of a bank – I have removed the currency and the name of the bank.

The bank could be any bank that (nearly) collapsed in 1992 and recovered. It could be Citigroup or a small property exposed regional (such as North Fork). But it isn’t.

It is Skandinaviska Enskilda Banken, a Swedish bank which – at least in those days – was more upmarket and had a large corporate loan exposure.

It was in deep trouble. It was involved in a government support process which – had they failed various tests – would have wound up in nationalisation. The market truly believed that it would be nationalised. The only thing that kept it liquid was the implicit support that if it failed certain capital tests (weak tests because buffers were reasonably used by that time) then it would be nationalised.

It didn’t fail the tests. It got some private money. And the stock went to the races. The stock was a 20 bagger in 18 months. The bank however was implicitly supported by a process that could end in nationalisation. (That is it was solvent and would have been illiquid if not for implicit government support. It was a crisis - but a crisis alone was not enough reason to nationalise a Swedish bank.)

Here is another chart – this one is Svenska Handelsbanken – one of the better managed banks in the world. It too was loss making at the height of the crisis – and it had elevated losses for several years.

This bank did not even apply to be enrolled in the government support program (though it did consider it). It decided (with some justification) that it would get by fine. However the bank sure looked done for.

Swedish bank nationalisation wasn’t done by a traditional Swedish semi-socialist government. It was done by a centre-right reformist government for whom nationalisation was anathema.

They developed processes which were certain and which some adventurous money could recapitalise the banks under clear rules. The process respected private capital.

Banks that were deemed to require capital had to raise it – if they couldn’t they were fed capital by government. If they required too much capital the government wound up owning them. But there were defined rules and a process.

This is how it is – with certain rules and a process not every American bank is going to die - and possibly some or most of the big six will survive. Some will live – and they will prosper. Nationalisation with process leads to 20 baggers. Oh, and zeros - 100 percent losses.

But we are here in limbo. The nationalisation meme has taken hold – and nationalisation of some banks will happen. America is a current account deficit country – and almost all American banks need wholesale funding. There is none of that since the Lehman/WaMu week – and there will not be substantial wholesale funding until the rules are clear. All banks will fail in that environment.

The faster we come out with a good process – one which has nationalisation as one (but not the only) possible outcome then banks will continue to fail. And ad-hoc decisions will be made to bail them out or confiscate them. And we will be no wiser. And no closer to a solution.

Investing and nationalisation

Equity investors should not fear the nationalisation meme. It happened in Sweden and two of the banks were 20 baggers. Svenska Handlesbanken was a 50 bagger to peak (and it still trading well above 100 kroner).

The “all banks are insolvent” idea is simply not true – and it is not going to help you make money forever (though it will work until a process is found). But – hey – while there are no rules – it all a crap shoot. We own no American bank common equities at Bronte. Short a few.

Waiting, hoping… hoping we really can become Swedish. You make the real money on the long side...

John

A post script is required. SEB – which was an OK – but not great bank – got itself entangled in the Baltic mess. It is

not quite as exposed as Swedbank – but it is not pretty. The stock is down from 250 to 50.

SvenskaHandelsbank has operations in the Baltic. Here is their

Estonian page. But the exposures are substantially less large and the stock is one of the better performing European banks. Hey – best bank last cycle – best bank this cycle. A solid culture is the only way to run a bank."

Me:

Don said...

"But there were defined rules and a process.

This is how it is – with certain rules and a process not every American bank is going to die - and possibly some or most of the big six will survive."

You have been making very good points lately. But, in September, many people argued for a version of the Swedish Plan. At that point, it wasn't even clear that any bank need be seized. The point was that the Swedish Plan was a plan, a model, that had been successfully used. It had the merit of:

1) Not being a hybrid, like TARP, with divergent interests

2) Because there was a plan, it could be assessed as it went along

3) It would put the taxpayer's interests first, which is what the taxpayers demand for the use of their money

4) It would be less easy to lobby, because there was a definite mechanism in place

5) It had real moral hazard, the threat of nationalization

Most of the people I read who favored this plan did not want the government to run banks at all, let alone for a short time. And that leads to:

6) It had a plan for the government getting out of these banks.

In other words, the main selling point, as far as I was concerned, is what you're calling for now.

The idea of a model is important, just as I remember reading that Sweden used aspects of the RTC in forming its plan.

All of this goes back to Bagehot, as far as I'm concerned.

Don the libertarian Democrat

No comments:

Post a Comment